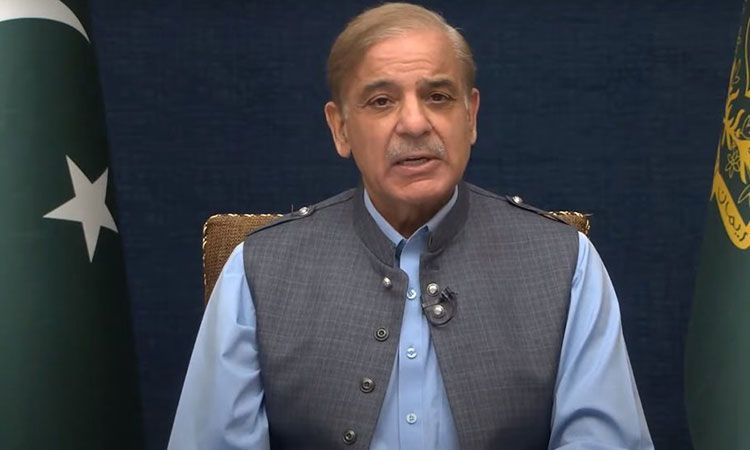

Prime Minister Shehbaz Sharif has formed a high-level inquiry team aimed at investigating the increasing cases of sales tax fraud in Pakistan.

The initiative follows alarming reports regarding fraudulent activities linked to public officials, tax policies, and the involvement of major entities in the illegal manipulation of sales tax systems.

This inquiry not only seeks to uncover these fraudulent activities but also aims to plug the gaps within the tax system to prevent such crimes in the future.

Overview of Sales Tax Fraud in Pakistan

Sales tax fraud is a serious issue in Pakistan, contributing to significant financial losses for the government. This fraud involves the falsification of invoices, misrepresentation of tax liabilities, and the creation of fictitious businesses that evade taxes.

These practices undermine the effectiveness of the Federal Board of Revenue (FBR) and other regulatory bodies.

In recent years, fraudulent activities have escalated due to loopholes in the country’s tax policies and the increasing involvement of public officials in tax evasion schemes.

The need for a comprehensive inquiry into these fraudulent practices has never been more pressing. Prime Minister Sharif’s inquiry team is designed to tackle this issue head-on and create a roadmap for reform.

The inquiry team has been specifically tasked with investigating the involvement of public officials, analyzing financial transactions, and identifying the systemic weaknesses that have allowed sales tax fraud to proliferate.

The investigation will examine the role of employees at Pakistan Revenue Automation Limited (PRAL), the Financial Monitoring Unit (FMU), and the Intelligence Bureau (IB), all of whom play a key role in monitoring and controlling sales tax collection and compliance.

The team, led by Musadiq M. Malik, Federal Minister, will include renowned experts and government officials such as Bilal A. Kayani (MNA), Tanvir Akhtar Malik (FBR), Ghazi Akhtar Khan, and Dr. Fareed Zafar.

The inclusion of these figures underscores the government’s commitment to addressing the scale of the issue.

One of the primary objectives of the inquiry is to investigate the involvement of public officials in sales tax fraud. Reports suggest that employees within the PRAL, which is responsible for managing Pakistan’s tax automation systems, may have been complicit in aiding fraud.

These officials may have helped fraudulent businesses by manipulating data or facilitating illegal tax adjustments. The inquiry will thoroughly examine these practices and hold any wrongdoers accountable.

The inquiry team will focus on scrutinizing financial and accounting records linked to sales tax fraud. They will analyze data provided by the Intelligence Bureau (IB) and Financial Monitoring Unit (FMU), two bodies responsible for tracking financial irregularities in Pakistan.

By identifying suspicious transactions and examining patterns, the team aims to uncover the full scope of fraudulent activities and the entities involved.

The inquiry team will also look into the decisions made by the Federal Tax Ombudsman (FTO) regarding past cases of tax fraud. Many of these decisions have been called into question for potentially enabling fraudulent practices rather than curbing them.

By reviewing these cases, the team will assess how these decisions have impacted ongoing tax fraud investigations and what changes are necessary to improve future legal proceedings.

Sales tax fraud thrives in an environment where policies are outdated or insufficiently enforced. The inquiry team will focus on identifying gaps in the existing tax policy that allow businesses and individuals to evade taxes.

Particular attention will be given to the use of fake invoices and the illegal adjustment of input tax credits. The investigation will propose reforms to close these loopholes and make it more difficult for fraudulent activities to go undetected.

Pakistan’s tax system relies heavily on automation to track and manage taxes. However, current automation systems have proven to be vulnerable to manipulation.

The inquiry will assess the role of automation in enabling fraud and suggest reforms to strengthen these systems. By improving the monitoring and enforcement mechanisms, the government can reduce opportunities for fraud and increase revenue collection efficiency.

Another issue contributing to tax fraud is the lack of accountability within the Federal Board of Revenue (FBR). Without robust checks and balances, the FBR has struggled to manage and oversee tax collection effectively.

The inquiry team will investigate how FBR officials may have failed in their duties, offering recommendations for strengthening accountability and improving governance within the organization.

Recommendations for Corrective Actions

The inquiry team will submit its findings and recommendations within a 30-day timeframe. These recommendations will focus on implementing corrective actions, including:

- Penal Actions Against Fraudulent Entities and Officials: The team will propose severe penalties for those found guilty of facilitating or engaging in tax fraud. This may include criminal charges, fines, and other legal actions to deter future offenses.

- Reforms in Tax Policy: To prevent future fraud, the team will recommend changes to tax policy, including stricter controls on the issuance of tax credits and stricter penalties for businesses found guilty of tax evasion.

- Improvements in Automation Systems: The team will recommend updating and strengthening the automation systems within the FBR to enhance data tracking, reduce fraud opportunities, and improve tax compliance.

- Enhanced Accountability and Oversight: Strengthening oversight mechanisms within the FBR and related agencies will help detect and deter fraudulent activities. The inquiry team will suggest measures to increase transparency and accountability.

The formation of the inquiry team led by Musadiq M. Malik is a decisive step in addressing the growing problem of sales tax fraud in Pakistan.

The team’s comprehensive investigation, focusing on policy loopholes, public official involvement, and systemic weaknesses, will provide valuable insights into the underlying causes of fraud and recommend corrective measures to improve the effectiveness of Pakistan’s tax system.

By implementing the recommended reforms, Pakistan can work toward a more transparent, efficient, and accountable tax system that minimizes the risk of fraud and ensures the integrity of the country’s financial management.