The Central Directorate of National Savings (CDNS) has introduced a revised profit rate for its popular financial product, the Regular Income Certificates (RICs), effective December 10, 2024. This reduction reflects ongoing adjustments to economic indicators and investor demand.

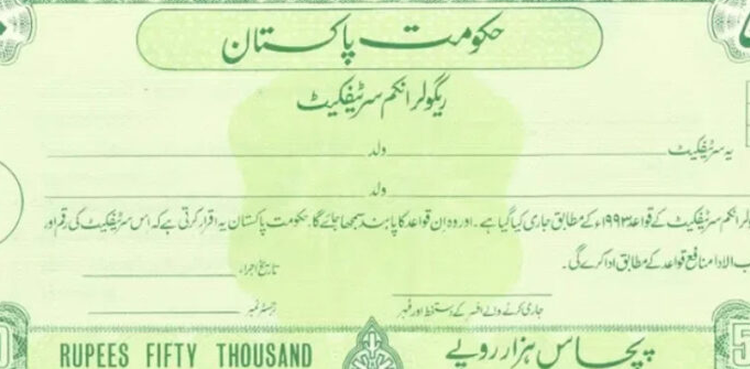

Introduced in 1993, the Regular Income Certificates were designed to cater to the monthly financial needs of the general public. With a reputation for stability and reliability, these certificates have remained a cornerstone of investment for many Pakistanis.

Available Denominations

Regular Income Certificates are available in a variety of denominations to suit the needs of different investors. These include:

- Rs50,000

- Rs100,000

- Rs500,000

- Rs1,000,000

- Rs5,000,000

- Rs10,000,000

This wide range ensures accessibility for both small and large investors.

Revised Profit Rates: December 2024

The profit rate for Regular Income Certificates has been reduced to 12.00 percent, down from the previous 12.10 percent. This adjustment translates to a monthly payout of Rs1,000 per Rs100,000 investment, compared to the earlier Rs1,010. While the reduction is minor, it underscores the CDNS’s commitment to aligning rates with macroeconomic conditions.

Key Benefits of Regular Income Certificates

Despite the rate adjustment, these certificates continue to offer attractive benefits, including:

- Zakat Exemption: Investments in Regular Income Certificates remain exempt from Zakat deductions, ensuring a stable and predictable return for investors.

- Security: As a government-backed financial product, RICs are among the safest investment options available in Pakistan.

- Accessibility: With denominations catering to diverse financial capacities, the product is suitable for a broad audience.

Historical Adjustments to Profit Rates

December 9, 2024

Just a day prior, the CDNS revised the profit rate for RICs from 12.72 percent to 12.10 percent, resulting in a monthly payout reduction from Rs1,060 to Rs1,010 for every Rs100,000 invested. These back-to-back adjustments reflect the institution’s responsiveness to economic changes.

November 2024

In November, the profit rate was cut by 0.24 percent, signaling the start of a downward trend. This earlier adjustment laid the groundwork for subsequent reductions in December.

Impact on Other Savings Products

Behbood Savings Certificates

Alongside the Regular Income Certificates, the Behbood Savings Certificates also saw a reduction in profit rates. Initially introduced in 2003, these certificates are designed to provide financial relief to vulnerable segments of society, including:

- Widows

- Elderly individuals

- Disabled persons (extended to special minors through guardians in 2004)

Denominations Available

Behbood Savings Certificates are offered in denominations ranging from Rs5,000 to Rs1,000,000, ensuring their suitability for various financial needs.

Revised Rates and Accessibility

In November 2024, the monthly profit rate for Behbood Certificates was reduced by 0.24 percent, with no additional changes in December. These certificates can be purchased from any branch of the Qaumi Bachat Bank across Pakistan, providing a convenient investment avenue for eligible individuals.

Why Regular Income Certificates Remain Attractive

Even with the profit rate reductions, Regular Income Certificates remain a favored choice for many investors. Here’s why:

Government-Backed Security

As a product of the CDNS, RICs are backed by the Government of Pakistan, offering unparalleled security for investors.

Steady Income Stream

Investors benefit from a predictable monthly payout, making RICs ideal for those seeking a steady income.

Tax Efficiency

The exemption from Zakat deductions enhances the financial appeal of these certificates, particularly for long-term investors.

How to Invest in Regular Income Certificates

Purchasing Regular Income Certificates is straightforward. Investors can visit any branch of the National Savings (Qaumi Bachat) offices across Pakistan to initiate their investment. The process typically requires:

- Identity Verification: A valid CNIC is required to initiate the investment.

- Minimum Investment: The minimum investment starts at Rs50,000, ensuring accessibility for a wide range of investors.

- Documentation: Basic documentation, including proof of address and source of income, may be required.

Future Outlook

The recent profit rate adjustments by the CDNS reflect broader economic trends, including changes in inflation and government fiscal policy. While rates have been reduced, the long-term attractiveness of Regular Income Certificates and similar savings products remains intact. Investors are encouraged to stay informed about future changes to maximize their returns