ISLAMABAD – July 28, 2025 – The Federal Government has officially revised the profit rates on various National Savings Schemes, as per the latest notification issued by the Ministry of Finance. The updated rates will come into effect from July 28, 2025, and will impact several popular savings instruments across Pakistan.

This step has been taken amidst ongoing fiscal adjustments, aiming to align public sector investment returns with broader economic indicators.

Key Changes in Profit Rates (W.E.F. 28-07-2025)

1. Special Savings Certificate/Account

- Old Rate: 10.6% per annum

- New Rate: 10.4% per annum

- 6-Month Profit (1st to 5th): Rs. 5,200 per 100,000

- 6th Profit (Last): Rs. 5,500 per 100,000

- Payment Frequency: Every 6 months

- Tax & Zakat: Withholding Tax (Filer 15% / Non-Filer 30%), Zakat 2.5%

2. Defence Savings Certificate

This long-term investment option offers increasing profits year by year, reaching up to 200% in the 10th year.

| Year | Profit % | Year | Profit % |

|---|---|---|---|

| 01 | 9% | 06 | 77% |

| 02 | 19% | 07 | 100% |

| 03 | 30% | 08 | 128% |

| 04 | 43% | 09 | 161% |

| 05 | 58% | 10 | 200% |

Subject to standard withholding tax and zakat deductions.

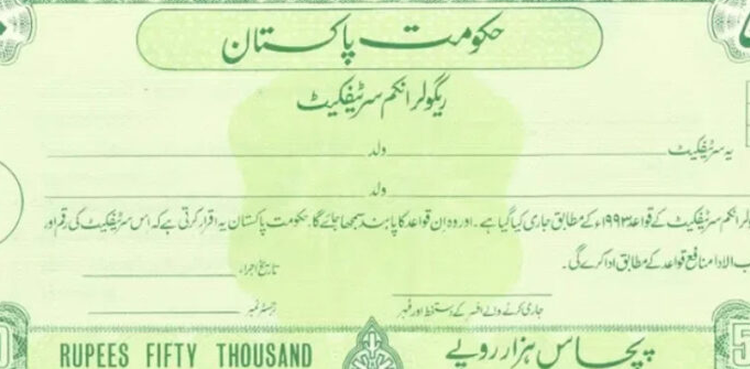

3. Regular Income Certificate

- Monthly Profit: Rs. 890 per 100,000

- Effective Annual Rate: 10.68%

- Taxation: Withholding Tax as per filer status

4. Bahbood Savings Certificate

- New Rate: 12.96% per annum (Reduced from 13.20%)

- Monthly Return: Rs. 1,080 per 100,000

- Eligibility: Widows, senior citizens, and physically challenged individuals

- Limits: Min Rs. 5,000 / Max Rs. 7,500,000

5. Pensioners’ Benefit Account

- Monthly Profit: Rs. 1,080 per 100,000

- Annual Rate: 12.96%

- Eligibility: Retired government employees only

- Investment Range: Rs. 10,000 – Rs. 7,500,000

6. Shuhadas Family Welfare Account

- Monthly Return: Rs. 1,080 per 100,000

- Annual Rate: 12.96%

- Eligibility: Families of martyrs (Shuhadas)

- Limits: Rs. 10,000 – Rs. 7,500,000

7. Short-Term Savings Certificates

Shorter investment options with quick maturity and returns.

| Duration | Annual Rate | Profit per 100,000 |

|---|---|---|

| 3 Months | 10.32% | Rs. 2,580 |

| 6 Months | 10.20% | Rs. 5,100 |

| 1 Year | 10.14% | Rs. 10,140 |

8. Savings Account (No Change)

- Rate Remains: 9.50% per annum

Islamic Savings Schemes (Sarwa Islamic Accounts)

9. SARWA Islamic Term Account (SITA)

- 1-Year Expected Return: Rs. 9,940 / 100,000 (9.94% annually)

- 3-Year Bi-Annual Profit: Rs. 5,150 / 100,000 (10.30% rate)

- 5-Year Monthly Profit: Rs. 900 / 100,000 (10.80% rate)

10. SARWA Islamic Saving Account (SISA)

- Monthly Profit: Rs. 828 per 100,000

- Annual Rate: 9.94%

Tax and Zakat Deductions

All National Savings instruments are subject to:

- Withholding Tax: 15% (Filers), 30% (Non-Filers)

- Zakat: 2.5% as per Islamic law

- Service Charges: As applicable on Islamic Accounts

Why This Matters to Investors

The revised profit rates particularly affect retirees, widows, and low-risk investors who rely on National Savings Schemes as a stable income source. Though slightly reduced, these rates remain higher than most commercial bank offerings, preserving National Savings’ appeal.

Investors are advised to:

- Re-evaluate their savings portfolio

- Compare returns vs. inflation

- Consult a tax advisor for net gain clarity

Final Words

The National Savings Schemes remain a trusted investment avenue for millions across Pakistan. While the profit rates have been adjusted slightly downward, they still offer competitive returns with government-backed security.